Getting My How Does Medigap Works To Work

Wiki Article

Medigap Benefits - Questions

Table of ContentsThe Greatest Guide To Medigap BenefitsSome Known Factual Statements About How Does Medigap Works Indicators on How Does Medigap Works You Should KnowNot known Facts About MedigapLittle Known Facts About What Is Medigap.

You will certainly need to speak to a qualified Medicare representative for prices as well as schedule. It is highly advised that you get a Medigap plan during your six-month Medigap open enrollment period which begins the month you turn 65 and also are registered in Medicare Part B (Medical Insurance Coverage) - What is Medigap. Throughout that time, you can buy any type of Medigap plan marketed in your state, also if you have pre-existing conditions.You might need to acquire an extra costly policy later on, or you may not be able to purchase a Medigap plan in any way. There is no guarantee an insurance provider will certainly market you Medigap if you request protection outside your open enrollment duration. Once you have actually made a decision which Medigap plan meets your requirements, it's time to figure out which insurance policy business sell Medigap plans in your state.

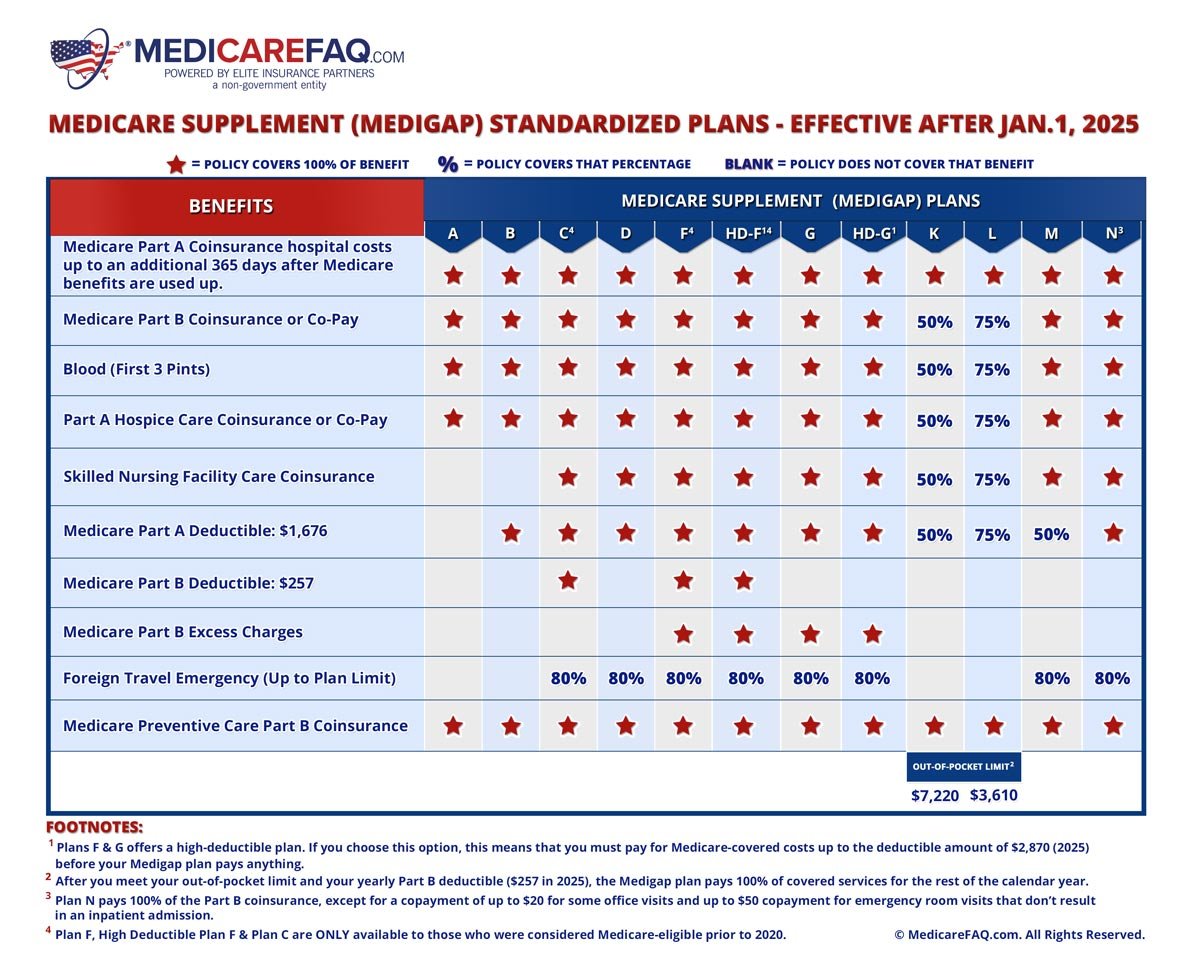

The precise protections depend on the type of plan that is bought and which mention you live in.

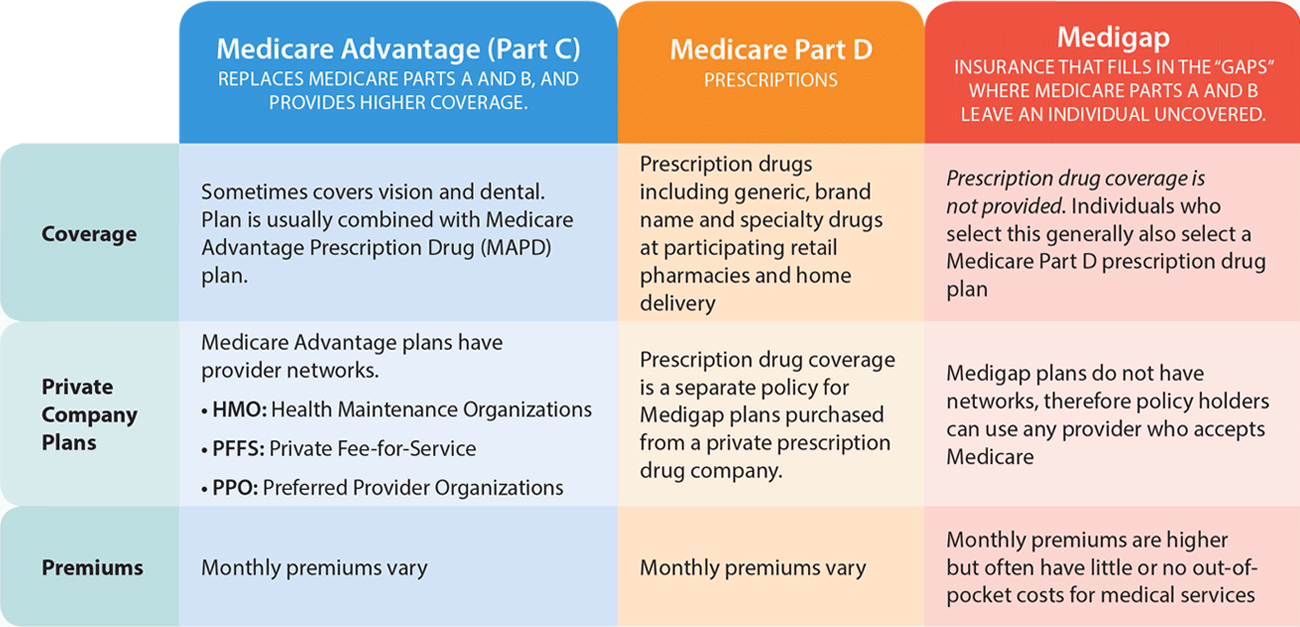

Called Medicare Part C.

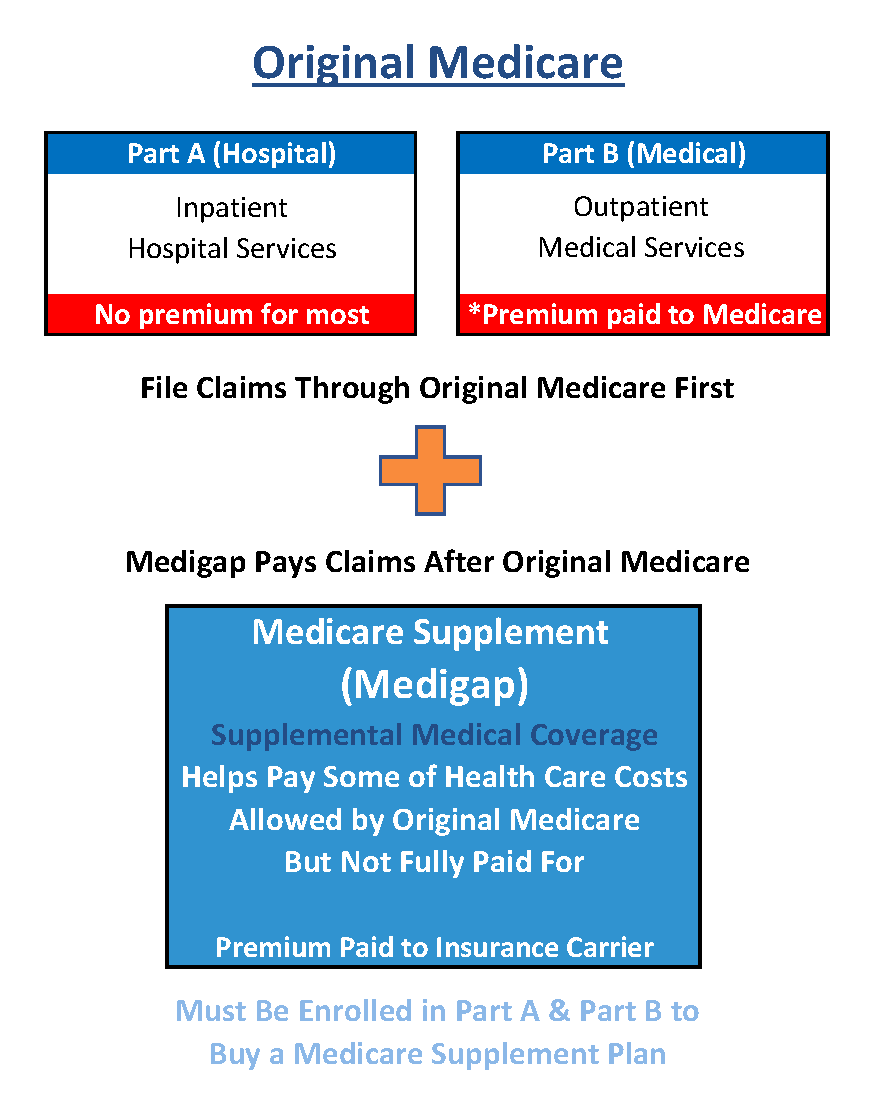

This is the percent of the price of a service that you show to Medicare. What is Medigap. With Component B, Medicare commonly pays 80% as well as the individual pays 20%. This is the amount of cash the person must pay of pocket for healthcare before Medicare starts spending for the costs. With Component A, there's an insurance deductible that applies to each advantage period for inpatient care in a medical facility setup.

3 Easy Facts About Medigap Explained

If you need health care solutions while taking a trip exterior of the United States, it is very important to comprehend that Initial Medicare does not cover emergency situation health care services or products beyond the U.S. Nonetheless, there are some things that Medicare supplement insurance policy normally does not cover, such as vision or oral treatment, eyeglasses, listening to aids, private-duty nursing, or long-lasting treatment.

Medigap prepares can aid you decrease your out-of-pocket healthcare expenses so you can obtain budget-friendly treatment for detailed healthcare during your retired life years. Medicare supplement strategies may not be appropriate for every single circumstance, however recognizing your choices will help you determine whether this sort of coverage could aid you handle healthcare costs.

Reporter Philip Moeller is below to supply the responses you require on aging and retired life. His once a week column, "Ask Phil," aims to assist older Americans as well as their households by addressing their healthcare and economic inquiries. Phil is the author of "Obtain What's Yours for Medicare," as well as co-author of "Obtain What's Yours: The Modified Keys to Maxing Out Your Social Security." Send your questions to Phil; and also he will respond to as several as he can.

Medigap Benefits Things To Know Before You Get This

The biggest gap is that Component B of Medicare pays only 80 percent of protected expenses. Probably, even more individuals browse this site would certainly buy Medigap plans if they might pay for the month-to-month costs. Nearly two-thirds of Medicare enrollees have basic Medicare, with concerning 35 percent of enrollees instead choosing Medicare Advantage strategies.

Unlike various other personal Medicare insurance coverage strategies, Medigap plans are controlled by the states. As well as while the certain coverage in the 11 various types of plans are determined by government policies, the costs as well as accessibility of the strategies rely on state rules. Federal regulations do offer guaranteed problem rights for Medigap buyers when they are new to Medicare and also in some circumstances when site web they switch over in between Medicare Advantage and also fundamental Medicare.

Once the six-month period of federally mandated rights has passed, state rules take over figuring out the civil liberties individuals have if they desire to get brand-new Medigap plans. Here, the Kaiser table of state-by-state rules is vital. It must be a mandatory quit for any person thinking of the function of Medigap in their Medicare strategies.

Excitement About How Does Medigap Works

I have actually not seen hard information on such conversion experiences, and regularly inform readers to check the marketplace for brand-new plans in their state before they switch right into or out of a Medigap strategy throughout open enrollment. Read More Here I suspect that concern of a feasible problem makes lots of Medigap insurance policy holders resistant to transform.A Medicare Select policy is a Medicare Supplement plan (Strategy A with N) that conditions the settlement of benefits, in entire or in component, on using network service providers. Network providers are companies of healthcare which have actually participated in a composed arrangement with an insurance firm to offer advantages under a Medicare Select policy.

Report this wiki page